econophysics and community currency

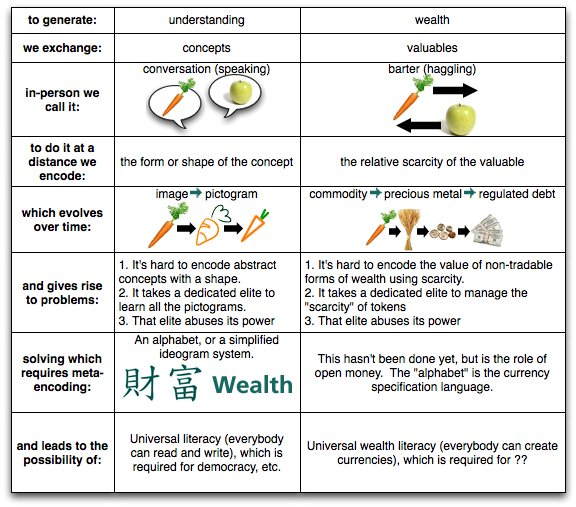

I’ve recently been introduced to the field of econophysics and I’ve read an interesting the review paper on the field. My thoughts on this paper is that it’s very good news for the community currency movement, if understood properly. For a long time when talking about cc, I’ve been using the little thought experiment of asking people to imaging the Buddha, Jesus and Mother Theresa sitting down to play monopoly and to see if the game will have a different outcome. The answer is obviously no, not if they play by the rules. It doesn’t matter how good or evil you are, the rules of monopoly simply require that all the cash end up in one player’s hands, i.e 100% inequity. The econophysics work on the Statistical Mechanics modeling of money takes this intuitive analogy and “proves” quite definitively the fundamental inequity of our current system if you assume that the rules of the game are that money behaves like energy. The good news for community currency arises out of the basic flaw of the paper which is it seems to imply that money is natural system, rather than a created one. If money were an inevitable natural system, then the paper could be seen as an justification of that structural inequity. But since it is a created one, rather it’s an explanation of the the inequity, and thus can point us very clearly in directions of how the monetary system should instead be re-designed. What are those directions? Well, we see in the paper the very careful arguments to show how money is conserved. This is crucial to the model because in the model money is energy, and statistical mechanics is built on the law of the conservation of energy. But more importantly their model is about statistical equilibrium of energy states in closed systems. So this gives us a clear indication of where to go: change the monetary paradigm to one where the fundamental model is based on non-equilibrium state energy systemics. Well, we know what non-equilibrium state energy systems are, they are living systems. In living systems what matters fundamentally is not how much energy is accumulated but rather, whether energy can be made to flow in particular complex patterns that themselves are self-sustaining. Even more crucially, life is not about what happens if energy is allowed to dissipate to equilibrium. The name for that process is death! So I think we could even argue that that the modeling they have done is of the death of an economy! Life is not about accumulation of the energy itself, but instead it is about the accumulation of the complex patterns of energy flows. The word for a such patterns is “ecosystem”. In their model money is seen as energy, or the capacity to do work. This actually makes sense for an early stage in the evolution of money. When the main issue is the scarcity of the capacity to get work done, then finding ways to accumulate it is key, and building an economic structure to generate that accumulation makes sense. We now live in a world where our capacity to do work is not at all scarce, it’s over abundant. The big problem is the waste human capacity (think of the structural unemployment) and also the squandering of all that massive capacity in ways that are blatantly destructive (military expenditures) or systemically destructive (climate change). So our task is now to re-gear the fundamental system to not simply accumulate of the capacity to do work, but mostly to accumulate particular patterns of that capacity that are what we call “healthy”. So, how do we do that!? I use a completely different model for money that I think fits the bill, namely that money is a form of language, or more precisely a writing system that encodes information about wealth events. This model transcends and includes the model of money as energy, because in its simplest form, the rules of the writing system can be made to follow the rules of conservation of energy. What I have been calling for and working on with open money (as well as collaborting with Art Brock on his OS-Earth platform) is a meta-currency system that is precisely about making it easy to create these many different writing system (currencies) and their rule-sets, or another way to put that, that precisely enables a the creation of pattern sets for economic flows.